The property market rarely waits. Auctioneers drop the gavel, calling for completion within a strict deadline. A vendor decides to accept an offer only on the condition that funds arrive next week. A homeowner discovers a once‑in‑a‑lifetime bargain but cannot release equity from a current address in time. In each scenario, the ability to draw several hundred thousand pounds within days can mean the difference between success and disappointment. An urgent bridging loan fills that exact need, turning asset value into short‑term liquidity far quicker than a conventional mortgage.

Although bridging finance has existed for decades, many still see it as a niche reserved for investors with specialist brokers. In reality, more than £8 billion in bridge transactions were completed across the United Kingdom during the past twelve months according to the Association of Short Term Lenders, with “fast” products the fastest growing segment. Understanding how these loans work, their cost structure, and their legal safeguards can help borrowers decide whether speed truly benefits their project.

What Makes a Bridge Loan “Fast”?

Standard bridging products already operate on a compressed timeline, often completing inside four weeks. A fast bridge pares that period down to as little as twenty‑four hours from signed application to drawdown. Three features stand behind the acceleration. First, lenders run asset‑backed underwriting, focusing on the security rather than the applicant’s salary. Second, automated valuation models or desktop surveys replace full structural reports where the property falls into a predictable residential bracket. Third, specialist solicitors act under dual representation, meaning the same legal team can process paperwork for both lender and borrower, cutting out postal delays.

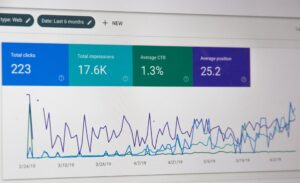

Technology removes further friction. Open banking delivers verified bank statements in seconds. Cloud‑based title search providers pull Land Registry data almost immediately, and indemnity policies cover any missing local search responses. By stacking these measures, a lender can reach a credit decision the same day a case lands in the queue.

Typical Scenarios Suited to Rapid Funding

Speed matters most when an asset would otherwise slip through the buyer’s grasp. Property auctions remain the headline use case, as contracts exchange at the fall of the hammer and completion follows within twenty working days. A fast bridge covers the hammer price and associated fees while longer‑term finance is arranged. Chain breaks present another common story: a buyer must proceed on a new home before proceeds from the sale of the old address arrive. The short‑term loan stands in for the missing equity, allowing the chain to repair itself without renegotiating every link.

Developers also draw on quick bridges to grab unmodernised dwellings before refurbishment. Because the funds arrive before planning approval or contractor quotes, investors can secure the title first and arrange development finance later. Business owners facing short deadlines for tax bills or shareholder exits occasionally use second‑charge fast bridges on prime residences, preferring a four‑month interest bill to the penalties charged by HM Revenue & Customs.

How Lenders Reach a Decision in Hours

Achieving twenty‑four hour completion demands tight coordination. Many firms pre‑approve borrower identities through biometric KYC checks well before a property is identified. Once an address is supplied, a desktop valuation assigns a conservative forced‑sale price. Loan‑to‑value ratios rarely exceed 75 percent for a first charge or 65 percent for a second, giving the lender comfortable headroom even if prices soften. Credit committees meet multiple times per day, and underwriters work extended hours to assess legal packs from auctioneers.

Legal firms on the panel run simultaneous searches, order indemnity policies where information lacks, and prepare a report on title that highlights any restrictions. Because the lender’s exit strategy normally rests on refinance or sale within twelve months, they also check the applicant’s plan and timetable. A clear, plausible exit is regarded as critical to approval.

Costs and How to Compare Offers

Fast bridging commands a premium over slower products. Monthly interest commonly ranges from 0.70 to 1.10 percent, a price many borrowers accept as the trade‑off for speed. Arrangement fees of up to 2 percent of the loan add to the headline cost, and procuration fees may reach 1 percent. To compare offers accurately, borrowers should request an annual percentage rate illustration that bundles interest, fees, and legal costs over the expected term.

Another expense comes from retained or rolled interest. In a retained structure, the lender deducts the entire interest bill from the advance on day one, so the borrower receives less cash than the gross loan. In a rolled structure, interest accrues and is repaid at redemption. Understanding which calculation applies avoids surprises at exit.

Responsible Borrowing and Common Pitfalls

Speed tempts some applicants to overlook fine print. Yet the same legal charge that secures a long‑term mortgage secures a bridge. If the borrower fails to repay on time, the lender may appoint receivers and sell the asset. For that reason, credible brokers advise setting the term long enough to absorb delays—often twelve months—even if the expected exit will arrive sooner. Early repayment charges are rare in bridging, so finishing ahead of schedule carries no penalty.

Borrowers should also read default interest clauses. Rates can double once a loan passes maturity. Clear communication with the lender, progress updates on the sale or refinance, and prompt settlement of minor arrears keep goodwill intact and protect the borrower’s reputation for future deals.

Fast bridging loans do not promise cheap money; they promise timely money. Where opportunity hinges on hours rather than weeks, the price can prove worthwhile. By understanding the mechanics behind rapid underwriting, keeping an eye on total cost, and planning a realistic exit, UK borrowers can employ this financing tool with confidence rather than haste.