by Kevin Lewis | Sep 24, 2024 | Finance

As a pet owner in Singapore, ensuring the health and happiness of your dog is likely one of your top priorities. Our furry companions bring so much joy into our lives, and just like us, they deserve the best care possible when it comes to their health. One way to provide that care is through dog insurance Singapore, which can help cover unexpected medical costs. This article will guide you through some of the options available in Singapore and why insuring your dog’s health could be one of the best decisions you make.

Why Consider Pet Insurance?

Dogs, like people, can face sudden health issues that require urgent care, and veterinary bills can quickly add up. Whether it’s an injury, illness, or even routine check-ups, medical care for pets isn’t cheap. Pet insurance helps protect you from these costs by covering part or all of your dog’s vet bills, depending on the plan you choose.

In Singapore, veterinary services are of high quality, and this can come at a premium. Accidents, illnesses, and conditions like hip dysplasia, cancer, or chronic skin conditions are just a few examples of situations that may require costly treatments. Pet insurance ensures you’re not forced to choose between your finances and your pet’s health when the unexpected happens.

What Does Pet Insurance Cover?

Most pet insurance policies in Singapore cover a range of medical treatments. This typically includes coverage for:

– Accidents: If your dog gets into an accident, such as being hit by a vehicle or injuring themselves while playing, insurance can help with the cost of emergency surgery or hospitalization.

– Illnesses: Diseases and illnesses can strike at any time, and treatments for conditions like diabetes, kidney disease, or even the flu can be expensive. Insurance can cover both the diagnostic tests and treatment needed.

– Surgery and Hospitalization: Some conditions may require surgery or extended hospital stays. Insurance can help cover both the surgery costs and the time your dog needs to recover in a veterinary hospital.

– Routine Care (in some policies): While not always included, some insurance plans may offer coverage for annual vaccinations, flea and tick treatments, or wellness checks.

Choosing the Right Plan

When it comes to selecting a pet insurance plan, there are a few important factors to keep in mind. Firstly, assess your dog’s needs. For example, if your dog is a senior or has pre-existing conditions, you may need more comprehensive coverage. On the other hand, if your dog is still young and relatively healthy, you might want to focus on accident coverage.

It’s also crucial to understand what’s excluded from coverage. Some policies do not cover pre-existing conditions or hereditary issues, while others may limit coverage for certain breeds prone to specific health problems. It’s always important to read the fine print of any policy to ensure you know what is included and what is not.

The amount you’re willing to pay for premiums is another key consideration. Higher premiums often mean more coverage, but it’s essential to find a balance that works for your budget. Be sure to compare policies and find one that fits both your financial situation and your dog’s healthcare needs.

Pet Insurance Providers in Singapore

Several insurance providers in Singapore offer pet insurance policies. While the specifics of each plan vary, here are a few popular options for pet owners:

- AIA Paw Safe: AIA’s pet insurance covers dogs against accidental injuries and medical expenses, including hospitalization. It also provides third-party liability coverage if your dog accidentally injures someone or damages property.

- NTUC Income: NTUC Income offers a plan that covers both accidents and illnesses. It also has a generous coverage limit and includes hospitalization costs for your dog.

- Liberty Insurance: Liberty offers comprehensive pet insurance that includes coverage for both accidents and illnesses, along with the option to add routine care coverage, such as vaccinations.

- CIMB Pet Insurance: CIMB’s policy focuses on accidental coverage and medical expenses, with plans that cater to both young and old pets. It also covers emergency boarding if you’re hospitalized and unable to take care of your pet.

These providers offer a variety of plans, so it’s worth exploring each to find the best fit for your pet and your budget.

Investing in Peace of Mind

While nobody likes to think about their pets getting sick or injured, it’s a reality that pet owners need to be prepared for. Pet insurance helps ease the financial burden when such situations arise, ensuring your dog gets the best care possible without putting undue stress on your finances.

With several insurance options available in Singapore, you can find a plan that suits your dog’s needs and your budget. It’s more than just an investment in your dog’s health—it’s an investment in your peace of mind. Knowing that you’re prepared for any eventuality allows you to focus on enjoying life with your beloved pet.

In the end, safeguarding your dog’s health is about being proactive and prepared. Whether your dog is a mischievous pup or a seasoned senior, pet insurance can be an invaluable tool in making sure they live a long, happy, and healthy life.

by Kevin Lewis | Dec 27, 2023 | Business, Finance

In the dynamic world of cryptocurrency, Binance Staking has emerged as a compelling strategy for investors looking to maximize their earnings. Staking involves holding funds in a cryptocurrency wallet to support the operations of a blockchain network, and in return, stakers are rewarded with additional coins. Binance, as one of the leading global cryptocurrency exchanges, offers a user-friendly staking service that provides a robust way to grow your crypto assets. Here’s how you can leverage Binance Staking to enhance your investment strategy.

- Simplified Staking Process

바이낸스 수수료 has streamlined the staking process, making it accessible even for those new to the cryptocurrency market. Unlike traditional staking, which often requires technical know-how and a continuous connection to the blockchain, Binance Staking allows users to earn rewards simply by depositing and holding coins on the platform. This method removes the complexities and makes earning from staking as easy as possible.

- Wide Range of Supported Assets

With Binance Staking, users have the flexibility to choose from a wide variety of supported cryptocurrencies. This range includes popular coins like Ethereum 2.0, Cardano, and Tezos, among others, providing a diversified portfolio of staking options. Binance continuously evaluates and adds new staking offerings, giving investors the opportunity to stake multiple assets and potentially increase their returns.

- Competitive Staking Rewards

Binance offers competitive staking rewards, with rates that are often more attractive than those found in traditional banking. The potential returns from staking on Binance can significantly surpass those from standard savings accounts, making it an attractive option for investors looking to optimize their earnings. Binance’s clear and transparent reward structure allows users to understand their potential returns before committing their funds to staking.

- Enhanced Security and Peace of Mind

Binance prioritizes the security of users’ assets. With industry-leading security measures, investors can stake their cryptocurrencies with the confidence that their funds are well-protected. Binance’s platform employs advanced security protocols to safeguard users’ investments, providing peace of mind while their assets earn staking rewards.

- No Lock-Up Periods for Flexible Staking

Binance offers flexible staking options with no lock-up periods for certain assets, allowing users to earn rewards while maintaining liquidity. This flexibility means that investors can stake their coins without committing to a fixed term and can withdraw their funds at any time. This feature is particularly appealing for those who seek both the earning potential of staking and the ability to access their crypto as needed.

- User-Friendly Interface and Support

Binance Staking features a user-friendly interface that makes managing staking assets straightforward. Users can track their staking returns, make adjustments to their staked holdings, and access comprehensive support resources directly through the platform. Binance’s dedicated support team is also available to assist users with any questions or issues, ensuring a smooth staking experience.

In conclusion, Binance Staking is a smart strategy for crypto growth, offering a simplified approach to earning rewards through staking. With its wide range of supported assets, competitive returns, enhanced security, flexible terms, and user-friendly platform, Binance Staking is an excellent option for investors looking to maximize their earnings. Whether you’re a seasoned investor or new to the crypto space, Binance Staking provides a valuable opportunity to grow your digital assets in a secure and efficient manner.

by Kevin Lewis | Oct 9, 2023 | Business, Finance

AI: Redefining Investment Strategies

Artificial Intelligence (AI) is a transformative force that has permeated various industries, including finance. With its advanced data processing and predictive capabilities, AI is significantly impacting how investment strategies are formulated and implemented.

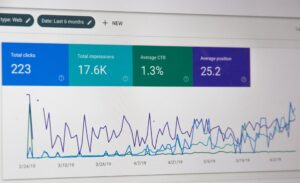

AI’s Superior Data Processing

One of AI’s main advantages is its ability to process and analyze vast amounts of data swiftly and accurately. This empowers investors with precise and timely insights into market trends, enabling them to make informed investment decisions. By relying on AI’s data-driven insights, investors can enhance their strategic planning and improve the profitability of their portfolios.

Predictive Analytics: AI’s Crystal Ball

AI’s ability to forecast future market trends is another significant advantage. Quantum AI algorithms can analyze historical data, identify patterns, and predict potential market movements. This predictive ability can be a game-changer for investment strategies, as it allows investors to take proactive measures, mitigating risks, and capitalizing on potential investment opportunities.

The Engendering of Robo-Advisors

The advent of AI has given rise to robo-advisors, automated platforms that provide digital financial advice based on mathematical algorithms. These platforms can provide personalized investment strategies based on an investor’s financial goals and risk tolerance. By making trading more accessible, robo-advisors are opening up investment opportunities to a broader audience.

Enhancing Portfolio Diversification with AI

AI is also significantly improving portfolio diversification, an essential aspect of any investment strategy. By analyzing various asset classes’ performance and predicting their future trends, AI can provide recommendations for optimal asset allocation. This can help investors build a more balanced and risk-mitigated portfolio.

The Synergy of AI and Human Judgment

While AI offers remarkable capabilities in shaping investment strategies, it does not replace the need for human judgment. The most effective investment strategies are crafted by combining AI’s data-driven insights with human expertise and intuition. It’s essential for investors to understand that AI is a tool designed to enhance their decision-making process, not replace it.

In conclusion, AI is reshaping how investment strategies are created and implemented. From superior data processing and predictive analytics to the rise of robo-advisors and improved portfolio diversification, AI’s impact on investment strategies is profound. As we continue to harness the power of AI, the key to successful investing lies in the effective combination of machine intelligence and human judgment.