AI: Redefining Investment Strategies

Artificial Intelligence (AI) is a transformative force that has permeated various industries, including finance. With its advanced data processing and predictive capabilities, AI is significantly impacting how investment strategies are formulated and implemented.

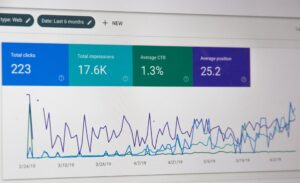

AI’s Superior Data Processing

One of AI’s main advantages is its ability to process and analyze vast amounts of data swiftly and accurately. This empowers investors with precise and timely insights into market trends, enabling them to make informed investment decisions. By relying on AI’s data-driven insights, investors can enhance their strategic planning and improve the profitability of their portfolios.

Predictive Analytics: AI’s Crystal Ball

AI’s ability to forecast future market trends is another significant advantage. Quantum AI algorithms can analyze historical data, identify patterns, and predict potential market movements. This predictive ability can be a game-changer for investment strategies, as it allows investors to take proactive measures, mitigating risks, and capitalizing on potential investment opportunities.

The Engendering of Robo-Advisors

The advent of AI has given rise to robo-advisors, automated platforms that provide digital financial advice based on mathematical algorithms. These platforms can provide personalized investment strategies based on an investor’s financial goals and risk tolerance. By making trading more accessible, robo-advisors are opening up investment opportunities to a broader audience.

Enhancing Portfolio Diversification with AI

AI is also significantly improving portfolio diversification, an essential aspect of any investment strategy. By analyzing various asset classes’ performance and predicting their future trends, AI can provide recommendations for optimal asset allocation. This can help investors build a more balanced and risk-mitigated portfolio.

The Synergy of AI and Human Judgment

While AI offers remarkable capabilities in shaping investment strategies, it does not replace the need for human judgment. The most effective investment strategies are crafted by combining AI’s data-driven insights with human expertise and intuition. It’s essential for investors to understand that AI is a tool designed to enhance their decision-making process, not replace it.

In conclusion, AI is reshaping how investment strategies are created and implemented. From superior data processing and predictive analytics to the rise of robo-advisors and improved portfolio diversification, AI’s impact on investment strategies is profound. As we continue to harness the power of AI, the key to successful investing lies in the effective combination of machine intelligence and human judgment.