The fusion of quantum computing and artificial intelligence (AI), known as Quantum AI, is starting to leave its mark on global financial markets, including international stock and cryptocurrency exchanges. This powerful combination offers profound advancements in processing speeds and analytical capabilities, leading to transformative effects on market operations, risk management, and regulatory compliance. This article delves into these impacts, illustrating how Quantum AI cypto trading is reshaping financial exchanges around the world.

## Transforming Market Operations

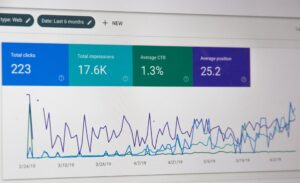

Quantum AI enhances the operational capabilities of financial exchanges by accelerating the execution of trades and optimizing the order-matching algorithms. In international stock markets, where milliseconds can mean the difference between significant gains or losses, Quantum AI’s ability to process and execute orders at unprecedented speeds dramatically increases the efficiency of trading activities. For cryptocurrency exchanges, which operate 24/7 across various global jurisdictions, the integration of Quantum AI ensures continuous, ultra-fast, and reliable transaction processing, accommodating the high volatility and trading volumes characteristic of these markets.

## Innovating Risk Management Strategies

Risk management is a critical component of financial market operations, requiring the analysis of vast amounts of data to identify potential risks and mitigate them proactively. Quantum AI revolutionizes this aspect by employing complex algorithms that can analyze data more comprehensively and at speeds unattainable by traditional computing systems. This capability allows exchanges to detect anomalies that suggest market manipulation or fraudulent activities almost instantly, significantly reducing the risk of financial losses. Furthermore, Quantum AI can model various economic scenarios in real-time, helping exchanges and traders make more informed decisions under uncertainty.

## Enhancing Regulatory Compliance

Compliance with international regulatory standards presents a significant challenge for financial exchanges, given the diverse and evolving nature of financial regulations across countries. Quantum AI can play a pivotal role in automating and enhancing compliance processes. By quickly parsing through the regulatory changes and adapting systems in real-time, Quantum AI minimizes the risk of non-compliance and the associated penalties. Additionally, Quantum AI can help in developing more sophisticated surveillance systems that monitor transactions across borders, ensuring compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations.

## Conclusion

Quantum AI is set to redefine the landscape of international stock and cryptocurrency exchanges significantly. By enhancing the speed and efficiency of market operations, innovating risk management strategies, and improving regulatory compliance, Quantum AI not only boosts the performance of these financial platforms but also ensures a higher standard of security and reliability. As Quantum AI continues to evolve, its integration into global financial markets signifies a new era of technological advancement with the potential to make international trading more robust, efficient, and transparent.